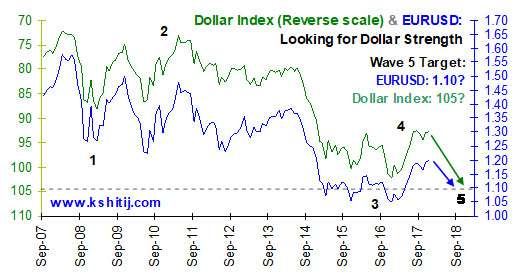

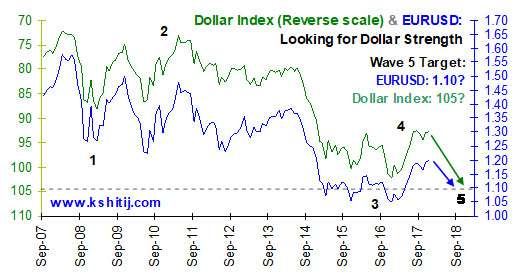

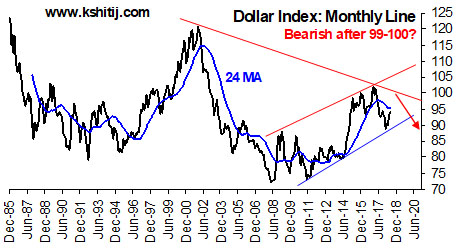

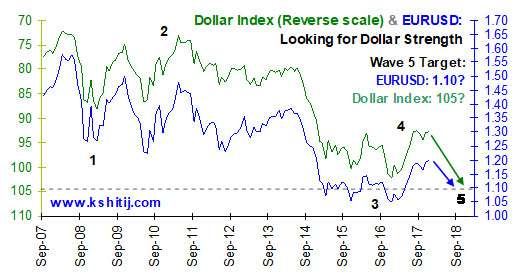

In Dec ’17, we were expecting Dollar to strengthen in 2018. At that time, Dollar Index (reverse) and Euro looked like they were about to begin a 5th wave in their downmove from 2008 (see chart below).

DOLLAR INDEX STRENGTHENED TO 95

DOLLAR INDEX STRENGTHENED TO 95

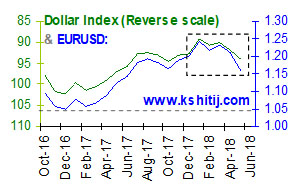

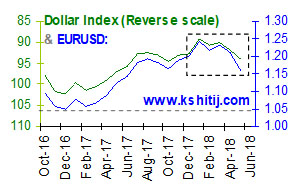

After 1 month of weakening (from 92.67 to 88.54), followed by 3 months of ranging between 91.0-88.5, the Dollar Index finally started gaining strength from end-April and has seen a high near 95.03 so far. It currently trades near 93.86.

The year has been marked by rising trade war tensions due to an unpredictable US regime, which possibly prefers a weak Dollar. At the same time, positivity around US growth and inflation have pulled up US yields and strengthened the Dollar.

UPSIDE IN 2018 COULD EXTEND TILL 99-100

UPSIDE IN 2018 COULD EXTEND TILL 99-100

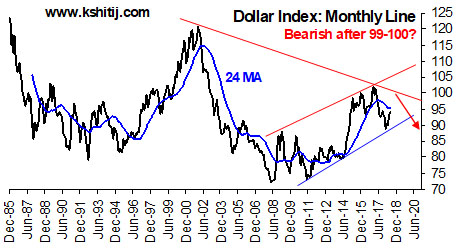

The chart alongside depicts a long term trendline coming down from 2002, which could restrict the upmove in Dollar Index to 99-100. If this line is broken, the channel trendline drawn from 2009 could then provide resistance near 105.

For the above two resistances to come into play, the 24 months MA near 95.5 would have to be broken.