18-Apr 2018: Euro 1.236

RECAP

In our last report dated 01-Mar-18, we explored the possibility of Euro falling to 1.18-16 in April-June due to a possibly bullish Gold/WTI ratio and seemingly overbought Euro derivatives positions. At the same time, we had retained our earlier “more preferred” view of a straight rise past 1.25-26 towards 1.30-35. The Euro has meanwhile ranged between 1.215-1.247 in March and April.

EXECUTIVE SUMMARY

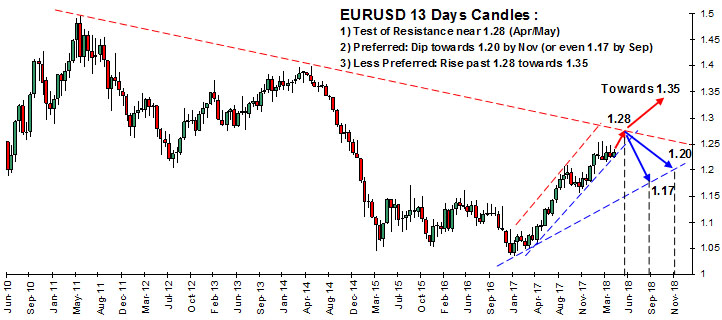

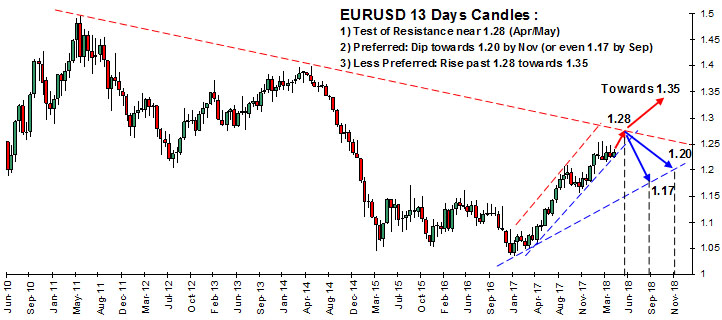

Euro is likely to test long term resistance (1.25-26; possibly 1.28) in Apr/May. After that, we prefer a dip towards 1.20-1.17 by Sep/Nov. A breach of 1.26-1.28 immediately after May is less preferred. This is because:

- The expected rise to 1.26-28 could mark the end of a 5 wave up move since Jan ’17.

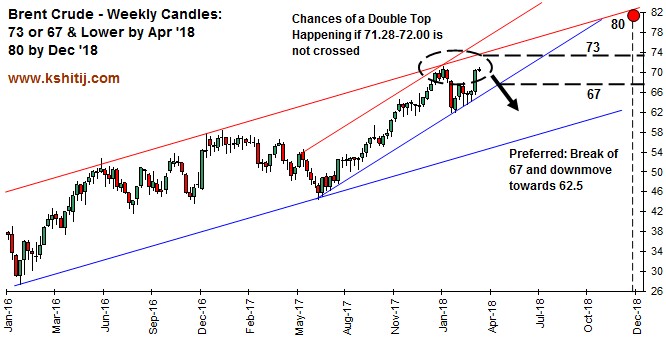

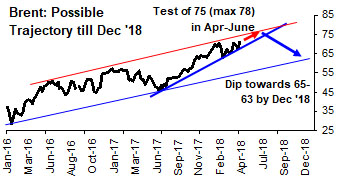

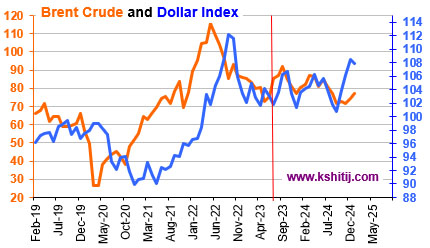

- Brent could rise to 75-78 by May ’18 and then fall to 65-63 by Dec ’18.

- Gold/Euro could bounce from support (1070) and a highly correlated Euro could simultaneously weaken.

We are effectively changing our earlier preference of a straight rise past 1.26, to a dip from 1.26-28.

CORRECTION AFTER 1.26-1.28

CORRECTION AFTER 1.26-1.28

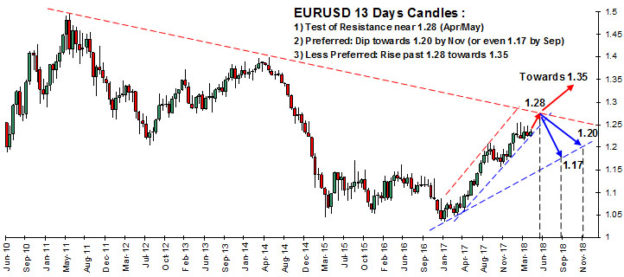

The adjacent long term chart presents the dilemma in question: There is striking similarity in pattern between the 2003 breach of long term resistance and the impending breach of long term resistance near 1.25-26 (possibly 1.28). The question is: Will this resistance be broken immediately (in Apr-May 2018) or, will there be a correction first?

Till now, we had preferred a straight break past 1.25-26, to target 1.30-35. However, mounting evidence suggests a dip towards 1.17 from 1.25-26 (possibly 1.28).

Since Jan ’17, Euro (1.236) has been rising in a 5 wave upmove and is currently in the last leg of the 5th wave. This last leg is likely to extend up till 1.25-26, but could also move further till 1.28, which is seen as resistance in the above 13 day candlesticks chart. After the end of the 5th wave near 1.25-26-28, a correction till 1.20-1.17 is possible (1.20 and 1.17 are obtained as the 23.6% and 38.2% retracements of the upmove since Jan ’17.) Moreover, a support trendline joining lows from Jan ’17 also yields 1.20-1.17 as a possible target zone on the downside.

EURO TO TURN BEARISH WITH BRENT?

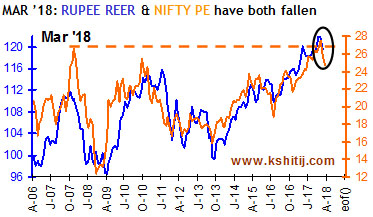

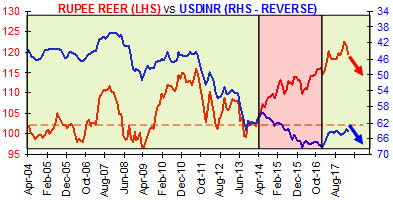

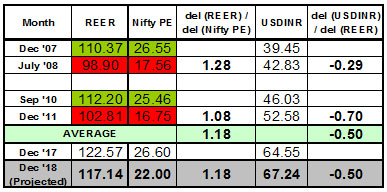

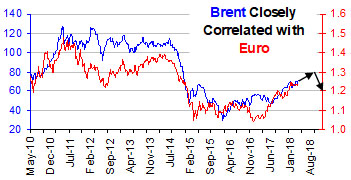

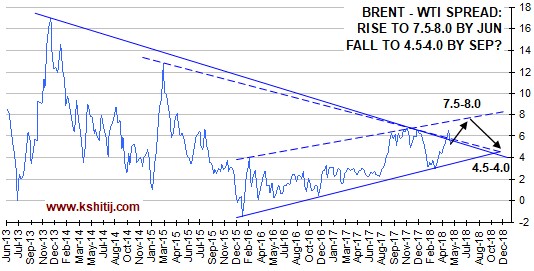

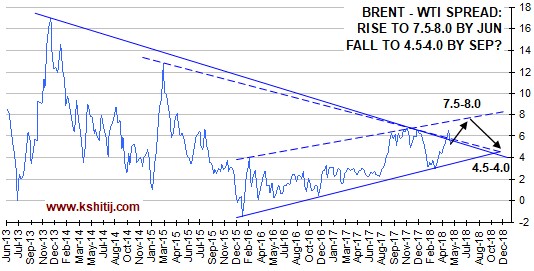

Euro has historically seen close positive correlation with Crude. In our Mar ’18 Crude forecast, our preference was for Brent (72.1) to break support at 67 and move lower towards 62 in Apr-Jun, followed by a rally in the second half of the year towards 77-80. However, the support has held, with Brent already seeing highs near 73. We believe it could stay bullish till 75-78 in Apr-Jun, and then, Jul-Sep could see it take a bearish turn towards 65-63. This syncs with our projection of near term bullishness in Euro, followed by bearishness from June onwards.

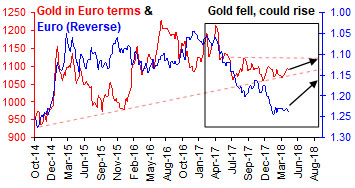

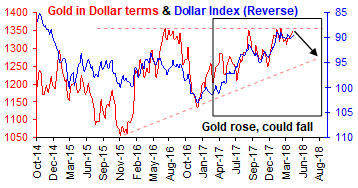

EURO COULD FALL AS GOLD/EURO RISES

Above, we see inverse correlation between Euro and Gold/Euro. Gold/Euro (1091) has fallen from 1212 in Apr ’17. It is currently bouncing from long term support near 1070 and could target 1130-1150, causing the Euro to weaken towards 1.17 (possibly even 1.15). Similarly, resistance on Gold (in terms of Dollar; currently 1348) near 1350-1370 could push it down towards 1300-1275 and the Dollar Index could strengthen towards 93-95, which is the same as saying that the Euro could weaken. The boxes in both graphs indicate a divergence in trend since Apr ’17 for Gold/Euro (downwards) and Gold in Dollar terms (upward). It would be reasonable to expect some convergence of trends to happen in the months ahead, which thereby implies Euro weakness.

CONCLUSION

Euro is likely to test long term resistance (1.25-26-28) by Apr/May. After that, we prefer a dip towards 1.20-1.17 by Sep/Nov. A breach of 1.25-26-28 towards 1.30-35 immediately after May is less preferred.