The Need for Dynamic rather than Static Benchmarks

May, 26, 2007 By Vikram Murarka 0 comments

Very few companies have adopted a formal plan or strategy for managing FX Risk. Amongst the few that have, most work on the basis of a fixed (static) benchmark for the whole year. We think Benchmarks need to be Dynamic, rather than Static.

The need for a Benchmark

A benchmark is needed in Risk Management for two reasons:

- It acts as a guide for the Risk Manager

- It is a number by which to judge the effectiveness of the Risk Management function

In contrast, a benchmark is not needed in accountancy because (a) accounts do not recognize Risk (b) it is not the job of accounts to provide direction and (c) the profit/ loss is just the difference between the rates that existed when an exposure came into being and when it was retired.

Essentially, a Benchmark rate is like a Budget rate. The Budget rate has no recognition in accountancy, but is an essential tool for management efficiency.

Construction of Benchmark should incorporate past as well as future

A benchmark could be based entirely on the past (for instance, what was the average rate in the past 1-3-6-12 months) or it could be based totally on the future (a forecasted rate or range). On the one hand, the rates in the future are unlikely to remain static at the rates of the past. On the other the future emanates from the past. As such we think it should be a mix of the two.

We have proposed a Benchmark (used in the monthly benchmark workings that we send to Clients) that takes important guidance from the past, but also considers a range of possibilities for the future. Ultimately, Risk Management has a lot to do with trying to anticipate and prepare for/ insulate from the future.

The objective of the Risk Management function would be to meet the Benchmark, because in so doing, it would ensure that all the possibilities have been met. If the benchmark can be bettered, of course that would be much more desirable.

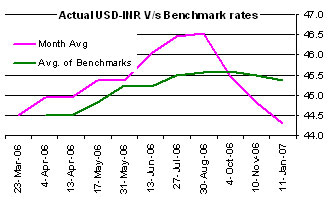

Look at the chart below. Here we have tracked the Average of Monthly Dollar-Rupee Benchmark Rates set by us in 2006 against the actual movement in Dollar-Rupee. As can be seen, if an Exporter had been able to achieve the Benchmarks (as seen in the chart), he would have been able to capture a good part of the upmove in the Dollar in the early part of 2006.

Tracking the above Dynamic Benchmark would have been better than pegging Exports at, say, 44.50, the rate that prevailed in Apr-06, when the annual budgeting exercise may have been done.

This brings us to our most important proposition: Should the Benchmark be static? Or dynamic? In some manners it can be said that a Benchmark, by nature, should be static. Else, how can it be relied upon to serve as a guide or be used to evaluate performance? We suggest, however, that the Benchmark should be dynamic because they allow the Risk Manager to address changing market conditions.

Consider this: is it not that Benchmarks are reset at least once a year? In that sense, they are not absolutely static, but are in fact, dynamic, across years. This idea is commonly acceptable. It is acceptable because it is accepted that every year brings a fresh outlook on the markets. Building upon this, when we know that the market conditions can change dramatically even within a year, we would be ready to accept the idea of a Benchmark that is updated within the year also.

If so, what remains to be decided upon is the periodicity with which the Benchmarks should be updated. We propose that they be reset Monthly.

The next objection to a Dynamic Benchmark is a little more vexing. How can a Benchmark, which itself changes, be used to evaluate performance?

Our answer to that is: To calculate P/L all that is needed are two rates. The calculation of the P/L is not the difficulty at this stage. The conceptual problem lies with the very change in the Benchmark.

Since the Benchmarks are to be reset on a monthly basis we should take the average of the benchmarks set in the last 12 months as the Rate/ Number to evaluate performance against. Thus, the Benchmark could both serve as an effective guide under changing market conditions as well as be used to evaluate performance.

The Purchase department and Sales departments in a company have quarterly or even monthly reviews and targets that are reset every time.

Why should the same concept not apply in Forex Risk Management, which basically involves either buying FX for Imports (the work of the Purchase department) or selling FX against Exports (the work of the Sales department)?

Think about it.

Write back to us with your views and questions!

Array

In our last report (29-Dec-25, UST10Yr 4.12%) we had said the US2Yr could fall to 3.00%. However, contrary to our expectation, the US2Yr has moved up. The US10Yr has also risen, much earlier than …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877