How Much Did You Really PAY/ RECEIVE?

Apr, 19, 2013 By Vikram Murarka 0 comments

The old financial year is over. The accounts are done and profit/ loss has been calculated. Hopefully you would have seen a good growth in turnover and profits. And, in the case of your Imports/ Exports, we certainly hope that you might have been able to avoid an exchange rate loss and show an exchange rate profit.

Looking at your forex risk management process, you would be keeping track of a number of rates. You normally keep a watch on the Spot Rate, the Forward Rate, maybe even option volatilities. In your weekly/ monthly exposure management reports you calculate your Import/ Export Book Rate (the rate at which your exposure is taken into your accounts at the time of its creation) and you calculate your hedge ratios. You also do mark-to-market calculations on your hedges. Besides all this, you also have to keep abreast of the global stock, commodity and money markets.

It is a lot of work, but it is necessary for prudent risk management.

Net Purchase/ Sale Rate

However, is it possible that despite all the hard work, you are totally unaware of that ONE vital variable that you really need to track? If you are an importer, do you know your Net Purchase Rate (NPR) for Dollars? If you are an exporter, do you know your Net Sale Rate (NSR)?

Simply, do you know how much you really paid for the Dollars you bought for your imports, or how much you really got for the Dollars you sold against your exports in the last month/ quarter/ year?

Use of the Net Purchase/ Sale Rate

Your actual net payment/ sale rate will give you the true picture of the effectiveness of your forex risk management policies and practices in clear and unambiguous terms. It is that one number which really matters because that is what impacts the CASH profit/ loss of your company.

There is a 99.99% chance that the rate at which your exposure (imports/ exports) is retired/ realized is going to be different from your "book rate" or the rate at the time you recognized your exposures in your accounts. If you do not hedge at all, your import payment/ export realization will happen at the Spot Rate on the date of import payment/ export realization. This is simple enough.

But, we all hedge in order to avoid the danger of a rise (or fall) in the Dollar as the case may be. We employ various techniques, tactics and tools to hedge. We rely on various forecasts. We spend a lot of time and effort on hedging. Some people believe in hedging 100% through Forwards on Day One. Some others do not hedge at all. Some people believe they can optimize their rate by trading in/ out of the market. Some people have a firm hedging policy that they stick to. Others keep experimenting with many different strategies. There are many approaches to risk management, with their own advantages and drawbacks. An earlier article in this series dealt with the drawbacks of common hedging methods

True Barometer of Effectiveness

Whatever be your own preferred approach to hedging, you can say your hedging has been effective/ profitable if, as an importer, your Net Purchase Rate (NPR) happens to be less than the Average Spot Rate (ASR). If you are an exporter, your Net Sale Rate (NSR) should be more than the Average Spot Rate (ASR).

In formulae terms: Gain for an Importer = ASR - NPR Gain for an Exporter = NSR - ASR

We suggest the above measure of effectiveness, because if you had not hedged, you would have got the Spot Rate on payment/ receipt date in any case. By hedging you should either pay less or receive more than that Spot Rate.

How to calculate the NPR/ NSR?

Say you are an Importer. Over a period of time, you might have hedged as follows:

- You would have hedged some part of your exposures using Forwards. Simple enough. And you might be having the wise policy of utilizing your hedges for actual payments, to the extent possible.

- Some part of your imports might have been hedged using Call Options. At maturity, some of them would have been exercised if the Spot on maturity was greater than the Strike. The others would not have been exercised and you would have paid for your imports at the Spot rate.

- A part of your exposures might have remained intentionally unhedged, because you should neither hedge 0% nor 100%, and you would have paid off those imports also at the Spot rate.

- During this period, you might have also engaged in some in-out-in-out forex trading on the Major currencies. Not necessary, but possible.

Given the above, you would calculate your Net Purchase Rate as shown in Example 1 below. As an Exporter, you can calculate your Net Sale Rate as shown in Example 2 below.

Example 1: Calculating Net Purchase Rate, for Importers

The NPR or Net Purchase Rate during September 2012 has been 55.32. As the Weighted Average Spot Rate during the period has been 54.6404, the hedges have not done well.

Example 2: Calculating Net Sale Rate, for Exporters

The NSR or Net Sale Rate during September 2012 has been 55.42. As the Weighted Average Spot Rate during the period has been 54.6404, the hedges have done quite well.

Comparing Imports (NPR) and Exports (NSR)

If the NPR (55.32) is compared with the NSR (55.42) we see that Importers have paid less than Exporters and vice versa (of course). If some company has both Imports and Exports, it has earned a NET Profit of 10 paise per Dollar between the two.

Importantly, the above example also shows that there is scope even for a company with a Perfect Natural Hedge to earn a net positive net differential between the NPR and NSR. This is worth striving for.

For your own good

The Accounting Standards do not required to calculate your Net Payment/ Sale Rate. But, do so for your own benefit. You might be surprised by the results. As the Hindi saying goes, "Doodh ka doodh, pani ka pani ho jayega."

Those who believe forex is their business and are really keen to do well in forex hedging, will take up the challenge.

Array

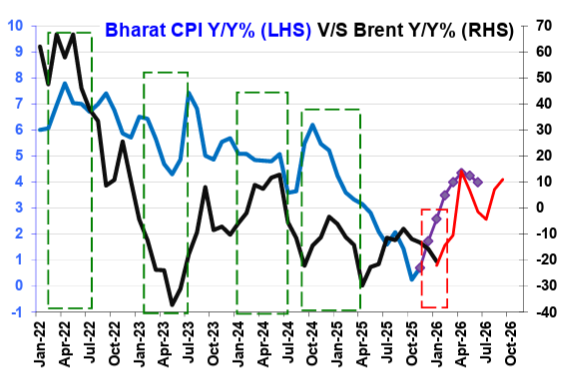

As expected in our last report (09-Dec-25, UST10Yr 4.16%) the US Fed indeed reduced the Fed Rate further by 25bp to 3.75%. We had also said that we expect another …. Read More

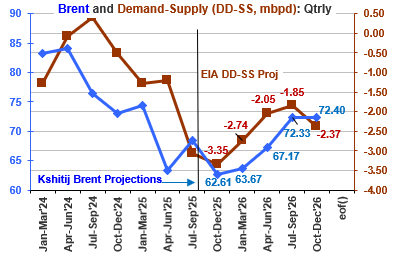

Crude prices have been steady and tilted to the downside over the last few months. Hovering near $60, can it gradually move up towards $70? Or could there be room for more fall towards $55/50? … Read More

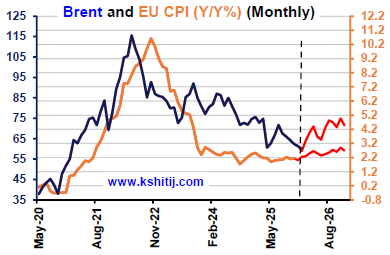

Brent and EU Inflation has been low in the last few months. If both the EU Inflation and Brent see a gradual rise in 2026, the upside could be …. Read More

In our 04-Dec-25 report (10Yr GOI 6.54%) we conceded that RBI may cut the Repo due to the unexpectedly sharp fall in the Oct-25 CPI to 0.25%. The RBI then indeed … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our January ’26 Dollar Rupee Quarterly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877