A Review - Born Again Sensex Bulls. (Jan-06)

Oct, 15, 2007 By Vikram Murarka 0 comments

Recap

22 moons ago, on 20-Jan-2006 , when the Sensex was 9311, we had said that “..although the Sensex has risen 300% since April-2003, there could still be a lot of room on the upside, if history is to repeat itself, and the current Bull Run may, in fact, be in its infancy”. For those who missed that report, it is available at http://colourofmoney.kshitij.com/born-again-sensex-bulls/

The market has risen another 100% since then, even after the terrible May-June 2006 fall, and the Sensex has closed above 19000 today. We thought it would be appropriate to take a fresh look at the charts.

Where to now?

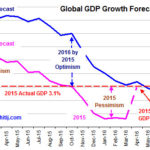

The “Sub-Prime” crisis in the US a couple of months ago had brought the world to the brink of, possibly, the worst financial disaster since 1929. But, then Super-Fed came to the rescue. Underscoring the overriding influence of the US Federal Reserve on the markets, almost all financial markets bottomed on 17-Aug, the day the Fed cut its Discount rate by 50 bps to 5.75%. The Sensex too bottomed on the same day, after hitting a low of 13779.88. The rally gained further wings after the Fed cut the Fed Funds rate, again by 50 bps, to 4.75%, on 18-Sep . The Sensex has rallied 21.62% in 18 sessions since then.

Please take a look at the daily Log Chart below. The Sensex is seen to have been moving up inside an upward sloping channel marked AA and BB, connecting the peaks at 6249.60 (Jan-04) and 12671.11 (May-06). It is now close to the upper end of this channel, with Resistance near 19800–20000 . Given the sharp upmove in the last few days, and the importance of the Resistance, it is time to be cautious and book partial profits on 16-22 month old Long positions. Although we don't want to become outright bearish given the massive inflows into Emerging Markets, the charts ask us to be prepared for 16000-15000, a 15-20% correction.

What could trigger a correction? We don't know. But, the answer could, perhaps, once again lie with the US Fed , which is scheduled to meet on 31-Oct. At the moment, our view is that Fed will not cut rates unless the global stock markets “misbehave”. But, a “no further rate cut” by the Fed could take the wind out of the markets' sail triggering a correction. Or it could be the soaring Crude prices.

Either way, this Deepawali, it might pay to have some cash in the bank.

Array

In our last report (29-Dec-25, UST10Yr 4.12%) we had said the US2Yr could fall to 3.00%. However, contrary to our expectation, the US2Yr has moved up. The US10Yr has also risen, much earlier than …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877