Fitness and Forex Hedging

Jun, 21, 2019 By Vikram Murarka 0 comments

Many a times I think the forex risk management practice resembles physical fitness. Everyone knows it is very important, but very few people do anything at all about it. Among those who hedge, few do it regularly, and fewer still do it scientifically.

The forex hedging landscape today is what the fitness industry scenario was 25-30 years ago, which is actually heartening. More people are aware of the need for physical fitness today than they were several years ago. Professionals keep sharing suggestions on diet, nutrition and fitness plans through newspaper articles. This encourages people to be more careful about their diet and to take up some sort of fitness regimen. Like people have become more health conscious over time, with more forex professionals writing about hedging, companies will certainly become more hedging conscious over time.

It was not always like this

However, it was not like this some 25-30 years ago. Fitness was equated with body building, which only wrestlers, boxers and some Hindi movie villains spent time on. This is akin to people equating forex hedging with only trading and speculation. Hindi movie heroes were generally not into fitness at all (remember Rishi Kapoor’s paunchy look in the 1990s and Sanjeev Kumar’s tyres in the 1980s?). Why, even cricketers were prone to muscle pulls and injuries all the time due to lack of fitness.

Thankfully, the fitness movement is a real thing today. Not only athletes and movie stars, but even corporate executives at all levels and across age and gender are taking greater care of their bodies, following the personal examples being set by corporate captains such as Rajiv Bajaj, Harsh Mariwala, Anand Mahindra and many others. Some are even pursuing serious running, cycling, some sports or the elusive six-pack abs, which is of the order of running serious derivatives programmes in forex. The daily fitness walk is more like basic hedging using Forward Contracts.

Today’s encouraging fitness landscape took a long time to build, with years of hard work by the likes of Mickey Mehta, Milind Soman, Rujuta Diwekar and several other fitness gurus, nutritionists, yoga veterans such as BKS Iyengar and Baba Ramdev, and legions of unknown daily practitioners who formed the bedrock of the fitness movement.

Coming to forex hedging, In its early days, post the 1991 Rupee devaluation and the introduction of LERMS in 1993, forex “hedging” was mostly about trading in forex by large companies and diamond merchants, which lasted till about 2000. Then came the Dollar-borrowing binge which ran from 2000 to 2008, during which companies threw all caution to winds egged on by bonus hungry bankers, finally resulting in the massive derivatives disaster of 2008, after which forex hedging virtually became a bad word.

Through all this, pioneers like Mr. AV Rajwade, Mr. Jamal Mecklai, ourselves and many others have been talking about forex hedging for more than 25 years now. Reliable forex forecasting (with the 73% Reliability of Kshitij forecasts) and systematic, scientific hedging (the KSHITIJ Hedging Method ) came into being from 2006 onwards, helping companies deal with increased Rupee volatility. Slowly, very slowly, more and more companies are at least starting to listen to forex advisors more seriously. There is still a long way to go, but the outlook is encouraging.

Prevention, rather than cure

The pursuit of fitness and well being is rooted in the maxim of “Prevention is better than cure” and is entirely different from going to a doctor in case of illness. People go to a doctor out of compulsion, usually when a lot of damage is already done. At that time, the doctor’s medicines can, at best, prevent the untoward and unfortunate, but cannot make the patient healthy and fit. Similarly, taking a hedge at a time of extreme volatility, out of compulsion, can at best prevent some forex losses, but cannot make the company risk tolerant.

Just as, at its worst, lack of fitness can show up in debilitating illness with ruinous costs, lack of forex hedging can cause severe balance sheet damages. That is why, those who have understood the vital importance of fitness pick up a fitness regimen out of choice and those who view forex risk management as a vital part of business, take up the practice of forex hedging on a regular basis, even if it is with simple forward contracts.

Benefits of FX Risk Management

The first benefit of a well thought out hedging policy, implemented properly, is that it makes a company more risk tolerant and enables it to handle volatility much more calmly and with least damage. This is similar to the increasing immunity levels through a regularly fitness regimen, which enables us to ride over normal illnesses like the cold, cough and common flu with relative ease.

Secondly, just as fitness reduces lethargy, makes us more energetic and enhances our daily performance levels, a proper focus on forex risk management brings greater efficiencies into a company’s day to day functioning. How? The data and information flow, planning, focus on the future, execution and the co-ordination and communication between various departments of the company that is necessary for proper forex risk management, all together add up to yield greater efficiencies.

It is easy to see that companies practicing proper forex risk management are likely to be more efficient in their businesses, even deriving a competitive advantage out of it, than those who either do not hedge at all or hedge off and on or even haphazardly.

Never too late to start

Most people tend to give up on sports and fitness once they start their working lives, largely due to lack of time. They take up fitness again when they either find the luxury of time after their initial years of struggle or they are hit by some illness or due to both reasons. Still, whenever they start on fitness, it is never too late to start.

Similarly, most companies, especially SMEs who find themselves dealing with issues of production, sales, garnering of finances and scaling up, tend to neglect forex risk management due to lack of bandwidth. They either start looking at forex when other parts of their operations have stabilized or when they are adversely hit by volatility, or due to both.

By the same token, whenever a company starts to get serious about forex hedging is good. It is never too late to start. The important thing is to take up forex hedging seriously.

If you are into fitness and into forex hedging and this has got you interested, you might want to follow the Kshitij Rupee forecasts (which have a reliability of 73 on 100) and read more on forex risk management concepts.

Array

In our last report (28-Jan-26, UST10Yr 4.23%) we had established the linkage between higher Crude and higher Inflation leading onto higher Yields and had said Yields were likely to move up along with …. Read More

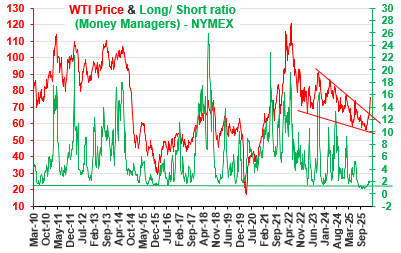

The Net Long short position for WTI has started to move up. Currently above 2, will it rise sharply towards 4-6 and higher or fall back towards 1.5 or lower? The US-Iran conflict has lead to a sharp rally in crude prices. Will it dominate prices in the coming months? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877