Euro Long term Forecast - Apr'18

Apr, 18, 2018 By Saandhy Ganeriwala 0 comments

18-Apr 2018: Euro 1.236

RECAP

In our last report dated 01-Mar-18, we explored the possibility of Euro falling to 1.18-16 in April-June due to a possibly bullish Gold/WTI ratio and seemingly overbought Euro derivatives positions. At the same time, we had retained our earlier “more preferred” view of a straight rise past 1.25-26 towards 1.30-35. The Euro has meanwhile ranged between 1.215-1.247 in March and April.EXECUTIVE SUMMARY

Euro is likely to test long term resistance (1.25-26; possibly 1.28) in Apr/May. After that, we prefer a dip towards 1.20-1.17 by Sep/Nov. A breach of 1.26-1.28 immediately after May is less preferred. This is because:- The expected rise to 1.26-28 could mark the end of a 5 wave up move since Jan ’17.

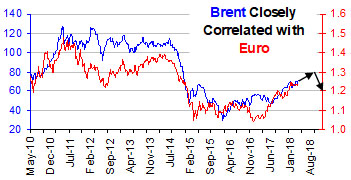

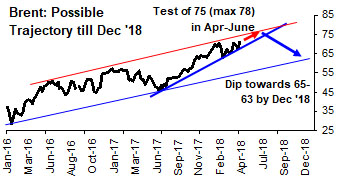

- Brent could rise to 75-78 by May ’18 and then fall to 65-63 by Dec ’18.

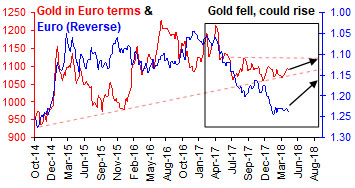

- Gold/Euro could bounce from support (1070) and a highly correlated Euro could simultaneously weaken.

CORRECTION AFTER 1.26-1.28

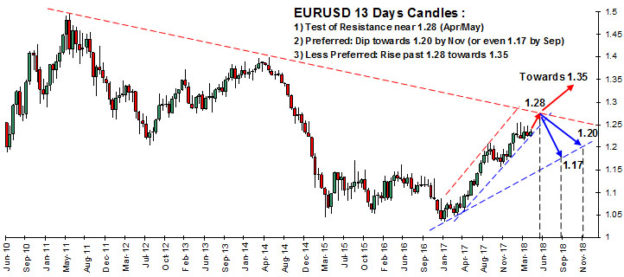

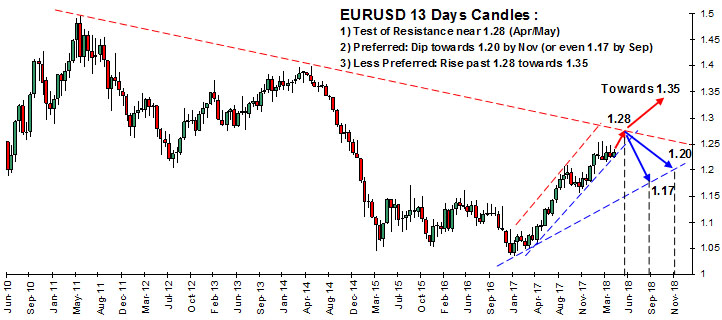

The adjacent long term chart presents the dilemma in question: There is striking similarity in pattern between the 2003 breach of long term resistance and the impending breach of long term resistance near 1.25-26 (possibly 1.28). The question is: Will this resistance be broken immediately (in Apr-May 2018) or, will there be a correction first?

Till now, we had preferred a straight break past 1.25-26, to target 1.30-35. However, mounting evidence suggests a dip towards 1.17 from 1.25-26 (possibly 1.28).

CORRECTION AFTER 1.26-1.28

The adjacent long term chart presents the dilemma in question: There is striking similarity in pattern between the 2003 breach of long term resistance and the impending breach of long term resistance near 1.25-26 (possibly 1.28). The question is: Will this resistance be broken immediately (in Apr-May 2018) or, will there be a correction first?

Till now, we had preferred a straight break past 1.25-26, to target 1.30-35. However, mounting evidence suggests a dip towards 1.17 from 1.25-26 (possibly 1.28).

Since Jan ’17, Euro (1.236) has been rising in a 5 wave upmove and is currently in the last leg of the 5th wave. This last leg is likely to extend up till 1.25-26, but could also move further till 1.28, which is seen as resistance in the above 13 day candlesticks chart. After the end of the 5th wave near 1.25-26-28, a correction till 1.20-1.17 is possible (1.20 and 1.17 are obtained as the 23.6% and 38.2% retracements of the upmove since Jan ’17.) Moreover, a support trendline joining lows from Jan ’17 also yields 1.20-1.17 as a possible target zone on the downside.

Since Jan ’17, Euro (1.236) has been rising in a 5 wave upmove and is currently in the last leg of the 5th wave. This last leg is likely to extend up till 1.25-26, but could also move further till 1.28, which is seen as resistance in the above 13 day candlesticks chart. After the end of the 5th wave near 1.25-26-28, a correction till 1.20-1.17 is possible (1.20 and 1.17 are obtained as the 23.6% and 38.2% retracements of the upmove since Jan ’17.) Moreover, a support trendline joining lows from Jan ’17 also yields 1.20-1.17 as a possible target zone on the downside.

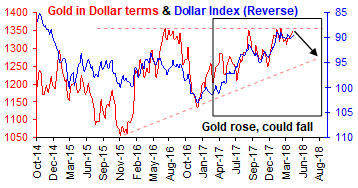

EURO TO TURN BEARISH WITH BRENT?

|

|

EURO COULD FALL AS GOLD/EURO RISES

|

|

CONCLUSION

Euro is likely to test long term resistance (1.25-26-28) by Apr/May. After that, we prefer a dip towards 1.20-1.17 by Sep/Nov. A breach of 1.25-26-28 towards 1.30-35 immediately after May is less preferred.

Saandhy Ganeriwala

Saandhy is a postgraduate in Economics, but like all good market-men, he seeks confirmation from technical analysis charts for his macroeconomic ideas. His research is a good mix of charts, stats and econ. Apart from that, he calls himself a news junkie and an occasional writer.

Array

In our last report (29-Dec-25, UST10Yr 4.12%) we had said the US2Yr could fall to 3.00%. However, contrary to our expectation, the US2Yr has moved up. The US10Yr has also risen, much earlier than …. Read More

Having risen sharply in Jan-26 to $70.58, will Brent again rise past $70 and continue to rise in the coming months? Or is the rise over and the price can move back towards $60? … Read More

Euro unexpectedly reached 1.2083 in Jan-26 on Dollar sell-off but recovered quickly back to lower levels. Will it again attempt to rise targeting 1.24? Or will it remain below 1.20/21 now and see an eventual decline to 1.10/08? …. Read More

The 10Yr GOI (6.6472%) had risen to a high of 6.78% on 01-Feb. It has dipped a bit from there but has good Support at … Read More

In our 10-Dec-25 report (USDJPY 156.70), we expected the USDJPY to trade within 154-158 region till Jan’26 before eventually rising in the long run. In line with our view, the pair limited the downside to … Read More

Our February ’26 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877