How paying Option Premium can actually be profitable

Feb, 16, 2008 By Vikram Murarka 0 comments

It is an open secret that every Corporate Hedger wants to pay no more than Zero for an Option that he buys. Banks oblige by constructing “zero cost” strategies. The concept of zero cost structures has become so ingrained in the general psyche of the market that when, at a seminar, we suggested buying Call Spreads at a cost, an experienced Hedger asked, “But, aren't Call Spreads supposed to be zero cost!” As if that is a cast-in-stone rule.

Like anyone else, we would love to be able to buy cheap Options. However, at the same time we are open to the idea of not only paying premium, but also the idea of paying higher premium, if there is an opportunity to make greater profits thereby. If this sounds strange, perhaps this trade example will illustrate.

In-the-Money Put Option

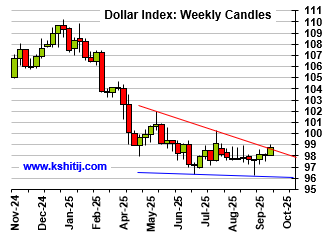

The GBP-USD was trading near 1.9690 on the morning of 04-Jan-08 , looking to fall towards 1.95 over a 1-month period and possibly towards 1.90 over 3-4 months. While an eventual fall looked pretty certain, an interim rally towards 1.98-99 could not be ruled out.

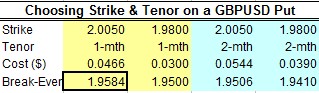

The idea, therefore, was to buy a Put Option, rather than to sell GBPUSD Forward. But, the Strike rate and the tenor needed to be figured out. We evaluated a combination of two strikes and two tenors.

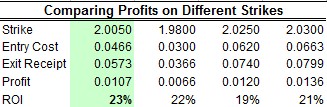

Both the strikes we evaluated were In-the-Money, at 2.0050 and 1.9850, as compared to the then At-the-Money-Forward rate of 1.9674 (Spot being 1.9690) for 1-month. The tenors considered were 1-month and 2-months. The cost and breakevens for each are given in the table alongside. We eventually decided to buy a GBPUSD Put, Strike 2.0050 for 1-month. This was despite the fact that the Premium (0.0466) for the 2.0050 1-mth Put was higher than those for the 1.98 1-mth and 1.98 2-mth Puts. The deciding factor was the Breakeven, which at 1.9584 was the highest for the combination we chose.

Both the strikes we evaluated were In-the-Money, at 2.0050 and 1.9850, as compared to the then At-the-Money-Forward rate of 1.9674 (Spot being 1.9690) for 1-month. The tenors considered were 1-month and 2-months. The cost and breakevens for each are given in the table alongside. We eventually decided to buy a GBPUSD Put, Strike 2.0050 for 1-month. This was despite the fact that the Premium (0.0466) for the 2.0050 1-mth Put was higher than those for the 1.98 1-mth and 1.98 2-mth Puts. The deciding factor was the Breakeven, which at 1.9584 was the highest for the combination we chose.

Better Off

As it turns out, our currency view proved to be correct and GBPUSD fell to 1.9520 by 11-Jan, just a week after we bought the 2.0050 Put. We did a position review. The Vols had fallen from 9.85% on 04-Jan to 9.08% on 11-Jan. Thus, we were making money on the currency (GBPUSD had fallen 0.86%) as well as on the Vols. At the same time, we had not lost a lot of time-value, because our initial target of 1.95 had been more or less achieved in just 7 days. We decided to unwind.

We had made a profit of 107 pips against an initial cost of 466 pips, a return of 23%. This was higher, both in pips as well as percentage terms, than what we would have made had we bought a 1.98 Put where we would have paid a smaller premium of 300 pips. Cheap (and Zero Cost) Options are not necessarily the only way to be profitable.

We had made a profit of 107 pips against an initial cost of 466 pips, a return of 23%. This was higher, both in pips as well as percentage terms, than what we would have made had we bought a 1.98 Put where we would have paid a smaller premium of 300 pips. Cheap (and Zero Cost) Options are not necessarily the only way to be profitable.

Sometimes it pays to pay more because you can end up making more!

Array

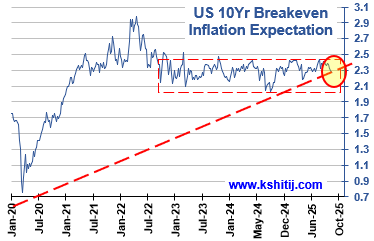

In our last report (09-Oct-25, UST10Yr 4.11%) we continued to expect the FED to cut rates by 25bp-50bp in its 29-Oct and 10-Dec meetings and for the US10Yr to dip to …. Read More

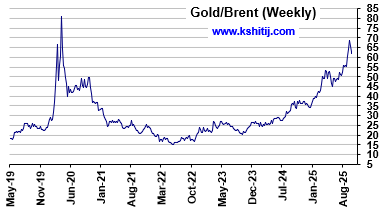

With sharp decline in Gold and Gold/Brent ratio, will Brent now start moving higher? Or will other geopolitical and global issues continue to weigh and put pressure for a lower crude price?… Read More

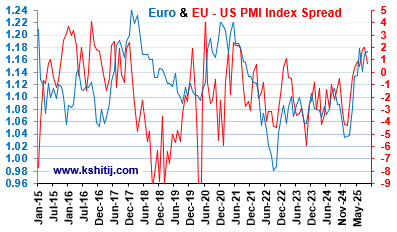

In our September 2025 outlook (15-Sep-25, EURUSD 1.1725), we expected Euro strength to be limited to 1.19/20, to be followed by a decline to 1.12 by Mar-26 and 1.0875 by Jun-26. We had expected a rise in the Euro after an expected …. Read More

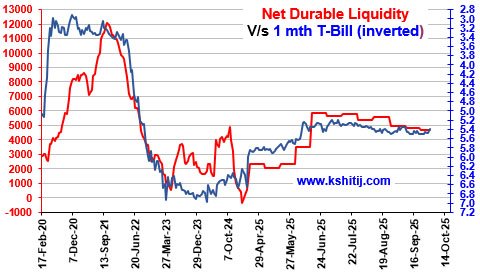

In our 10-Sep-25 report (10Yr GOI 6.48%) we expected the RBI to be on pause in its next MPC meeting on 01-Oct. This is to be seen tomorrow. We had also said there was room for the FOMC to cut rates by 25-50bp, and accordingly they … Read More

In our 12-Sep-25 report (USDJPY 147.96), we expected the USDJPY to limit the downside to 144 and ascend towards 155-158 in the coming months. In line with our view, USDJPY limited the downside to … Read More

Our October ’25 Dollar Rupee Quarterly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877