Issues in Corporate Forex Risk Management

May, 26, 2007 By Vikram Murarka 0 comments

Netting – An outdated concept?

Netting – An outdated concept?

A company has both Imports and Exports. Should it manage the FX Risk on both legs, i.e. on Gross basis? Or on the differential amount, i.e. on Net basis? Many companies seem to prefer the latter, managing FX Risk on a Net basis, seduced by the concept of “Natural Hedge”.

We have an issue here. Our contention is that FX Risk should be managed on a Gross basis. Conceptually, it is agreed that the company has a natural hedge to the extent Imports and Exports cancel each other. But, on an operational level, do they really cancel each other out? There are bound to be Time and Amount mismatches. Reason enough for the Risk Manager to manage Imports and Exports separately, individually.

Assume, for the sake of discussion, a scenario where there is no Time and Amount mismatch. Is it then acceptable to manage risk on a Net basis? To our mind, it is not. Here’s why.

Old Literature

The concept of Netting is based on old Risk Management literature, of the Eighties and Nineties, which pertained more to Banks than to Corporates. The market was different then. Europe still had several currencies, each with varying degrees of liquidity. Bid-Offer Spreads were high even in the most liquid currency pairs such as USD-DEM, ranging from 5 to 7 to 10 pips. Even 20 pips in times of volatility! It made sense then, to work on a Net basis, so as to minimize the confusion of so many currencies and to minimize the leakage due to high Bid-Offer Spreads.

The business environment itself was a little easier than it was today, given the lower degree of globalisation at that time. Competition was less acute and margins from core business were higher. There was lesser need to extract juice from each and every business operation, especially from FX Management.

Current Reality

The situation is different today. After the advent of the Euro in 1999, we now deal with fewer currencies. Market volumes have grown tremendously and market breadth has widened, bringing Bid-Offer Spreads down to a sliver.

Business is itself tougher today. Competition is high both domestically and internationally. Core business margins have been driven down to wafer thin levels across most sectors globally, except, perhaps for the IT industry in India.

Thus, while the need to avoid bid-offer spreads has decreased, the need to extract juice from each and every business operation has grown.

Need for Speed

Does any company buy its raw materials and sell its finished products at the same price? Obviously not. Every company tries to buy its raw materials at the lowest possible rates and sell its products at the highest possible rates. We need to look at currencies in the same manner as any other commodity or product. Profit maximization demands that Imports and Exports should not be netted off against each other. The effort has to be to cover Imports when the rates are low and to cover Exports when the rates are high - whether this happens in the span of a day, a week, a month or even an year.

But, would that lead to too much risk? Not so. In fact, currencies are less volatile and thus less risky than some of the commodity markets that businesses are routinely exposed to.

Not as volatile as commodities

Metals, Oil etc display much higher volatility, simply because the markets are not as large as the currency market. Further these commodities are far less liquid. Also, most commodity markets are Futures driven, as opposed to the currency and interest rate markets, which are OTC driven. As such, settlements can be more tailormade in the currency markets.

Companies routinely deal with price fluctuations ranging from 10-80% in their input raw materials, without batting an eyelid. Can they then not manage currencies, which are much less volatile, in a more proactive manner?

Sound risk management practices would ensure that undue risks are not be taken. The currency market itself being less volatile would ensure that the business is not exposed to huge risks. Makes sense?

Array

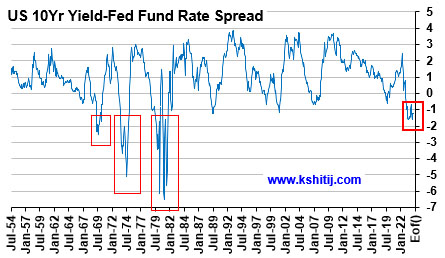

In our last report (23-Feb-24, US10Yr @ 4.25%), we had laid out our near term view (that the ongoing rise in the US10Yr may/ may not extend up to 4.5%), our medium term view (that the US10Yr can still fall to 3.5%) and our long term view of a rise towards 5.0% and higher going into 2025. …. Read More

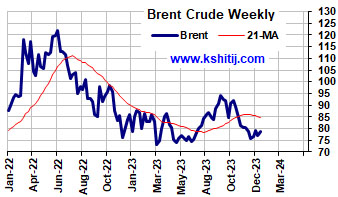

After breaking above the earlier range of $70-85, Brent has moved up higher. Will it sustain and break above $90? Or will it fall back to $80/70? … Read More

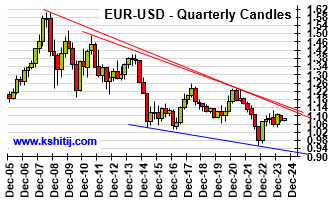

Euro could not move above 1.0981 in March and has been trading well below 1.10 post the surprise rate cut by SNB last month. Will Euro continue to trade below 1.10? Or can it remain stable for a while and show a sharp breakout above 1.10? ……. Read More

Our April ’24 Quarterly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our March ’24 Monthly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877