Can this US election be different from history

Nov, 02, 2016 By Vikram Murarka 0 comments

02-Nov-16 / DJIA 17960

EXECUTIVE SUMMARY:

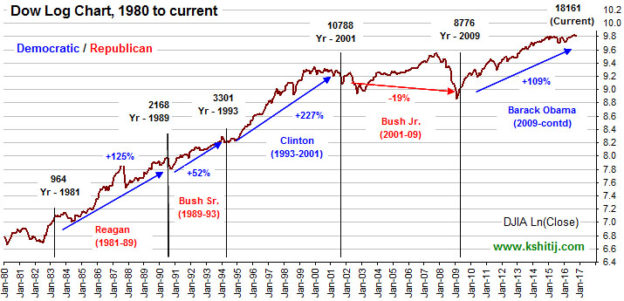

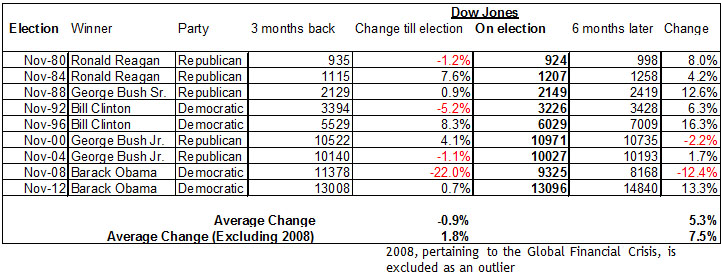

The US stock market generally remains unaffected by the presidential election in the long run, as evident from the chart below. Except for the tenure of George Bush Jr. (2001-09), all the presidential tenures have seen almost uninterrupted bull markets. Regarding the short to medium term impact, the table below indicates that the market generally tends to rise going into the election and performs even better after the election. History doesn’t show major disturbance due to the election and it remains to be seen if this impending election can trigger something different. Chances are, even a Republican victory this time may not produce more than a knee-jerk reaction to the downside and the long term uptrend may sustain.Dow Jones performance around US Presidential election:

Array

In our last report (29-May-25, UST10Yr 4.45%) we had stuck to our previous forecasts, calling for the US2Yr to dip to 3.2% and the US10Yr to 3.6%. Although those levels are …. Read More

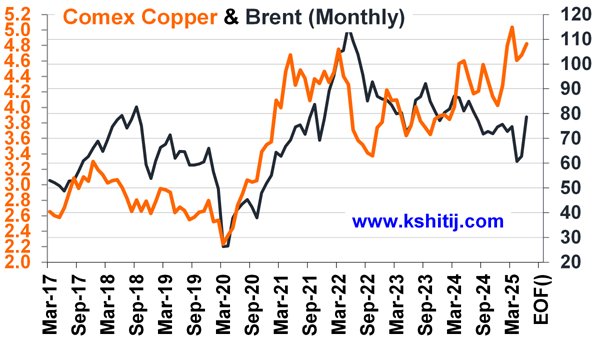

Brent rose sharply from $58.20 itself instead of extending the fall to our expected $55, meeting our long-term target of $70 much sooner than expected. The acceleration in crude prices have been triggered by … Read More

Euro has moved up sharply over the last 4-5 months and faced volatility admist the trade tariff talks and other geopolitical tensions globally. Will the uptrend continue and take it to fresh highs in the coming months? Or can there be any corrective consolidation or decline? …. Read More

Our June ’25 Dollar Rupee Monthly Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

Our June’25 Monthly Dollar-Rupee Forecast is now available. To order a PAID copy, please click here and take a trial of our service.

- Kshitij Consultancy Services

- Email: info@kshitij.com

- Ph: 00-91-33-24892010

- Mobile: +91 9073942877